Workers Comp And Independent Contractors

Professional liability

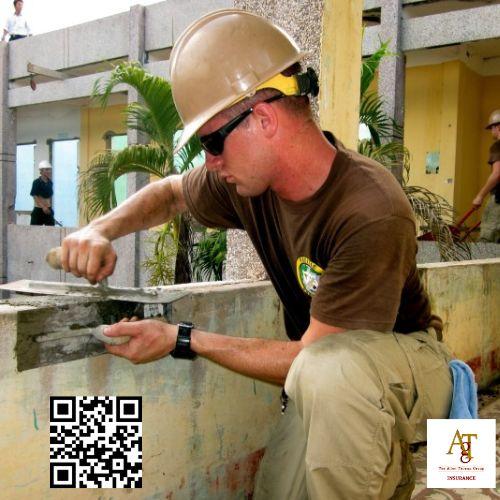

Like any business owner, an independent contractor may be sued and held liable for damages. Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, this coverage is crucial for contractors who provide professional services or advice. Contractors face unique and often dangerous risks everyday on the job. These options offer you and your client protection should they find themselves involved in a lawsuit alleging third-party bodily injury, property damage, or reputational harm. As a contractor, you are responsible for the safety and security of the property you are working on, and accidents can happen.

Umbrella insurance boosts your liability limits. The Allen Thomas Group Contractor Insurance . To show a client that you are covered, request a general liability certificate of insurance. Construction is an inherently risky industry. This option is usually more cost-effective for your clients.

Theft leaves equipment missing. Insurance rates for contractors vary widely based on factors like:Your risk profile - higher risk trades like roofing and electrical cost more than lower risk trades like painting or flooring. Auto liability insurance The Allen Thomas Group can assist in finding insurance quotes for construction contractors, landscapers, cleaning services providers, professional service providers and freelance professionals across a range of industries. A BOP bundles both coverages into one policy with usually lower insurance premiums than purchasing them separately from individual insurers.

While some companies offer a “one-size-fits-all” contractors insurance policy, we know every contracting business is unique. A knowledgeable insurer is essential to your success - our Risk Control, Underwriting and Claim professionals specialize in your industry and can assist in managing complex indemnity, additional insured and contractual exposures more effectively. This not only helps contractors avoid financial burdens but also ensures that clients are not left with the financial burden of repairing or replacing their property. Without this insurance, they could be held responsible for alleged wrongdoing or accidents caused by you or your work.