Cheapest Contractor Insurance

Insurer

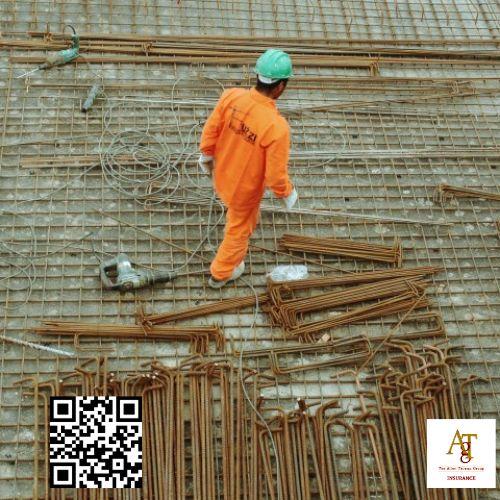

Our specialized construction underwriters have deep industry knowledge and an ability to provide flexible, innovative solutions.

Cheapest Contractor Insurance - Rental property insurance

- Claims-made and reported policy

- Commercial general liability

- Insurable interest

- Rental property insurance

- Employment practices liability

- Subcontractor

Cheapest Contractor Insurance - Insurer

- Rental property insurance

- Employment practices liability

- Subcontractor

- Business owners policy

- Commercial auto insurance

- Policy

Don't wait for a loss to realize you're underinsured – be proactive and protect your assets with The Allen Thomas Group. Coverage options also may extend to cover vehicles used by your employees as well as employees themselves depending on which coverage options are selected. Materials or tools from your truck damage a car while in transit. It’s required in most states for businesses that have employees.

Common trades that need contractors insurance include:Even if it isn't required by contract, having insurance is always prudent. Our broad, tailored coverages and enhancements are based on our deep knowledge and experience in the construction industry, and specifically designed to meet the needs of our customers. Protect against things like lawsuits and other liabilities with contractors insurance through The Allen Thomas Group . Importance of Liability InsuranceLiability insurance plays a vital role in safeguarding businesses and individuals by providing protection against accidents and injuries.

You can purchase commercial general liability insurance from a business insurance provider or agency. Contractors insurance usually covers business liability exposures, such as injuries or damage to a client’s property for which your business is responsible. One of the main benefits of contractor insurance is that it provides financial protection in the event of accidents or property damage. Protection for fixed property under construction and equipment used during the process - be it in transit, storage or on site.