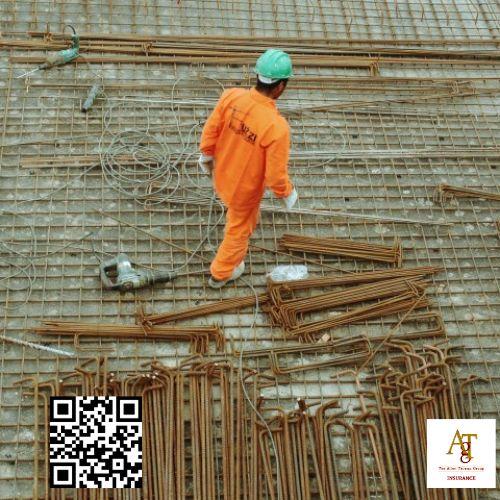

General Liability Insurance For Contractors

Surety bond

This is where Surety Bonds come in - providing a guarantee you will meet all contractual obligations. The coverages in contractors insurance can vary from business to business. Umbrella Insurance: This additional coverage provides extra liability protection beyond the limits of other insurance policies.

General Liability Insurance For Contractors - Commercial auto insurance

- Retroactive date

- Blanket coverage

- Terrorism insurance

- Exclusion

Provide organizations of all sizes with coverage against data breaches and other fast-evolving cyber risks. Without insurance, you would have to pay out of pocket to defend yourself in court and also pay for damages. Comprehensive policies protect against liability claims and property damage if your drivers cause an accident. The Allen Thomas Group Contractor Insurance .

With the right insurance partner, you can run your business with confidence knowing you've safeguarded your company's finances and reputation. Liability coverage protects you from these claims long after the job is done.- Protects from third party bodily injury and property damage claims- Covers legal defense fees and lawsuit damages - Applies to incidents on worksites and completed projectsGeneral liability policies come with defined coverage limits - typically for per occurrence and in total annual claims. Avoid choosing coverage based on cost alone and work with agents who truly understand your business.

These options include general liability insurance, workers' compensation insurance, and umbrella insurance. If this occurs to you, HNOA coverage could provide additional protection - read up on these policies today if needed! At The Allen Thomas Group, we understand the unique risks contractors face and provide customized insurance solutions to keep your business safe.