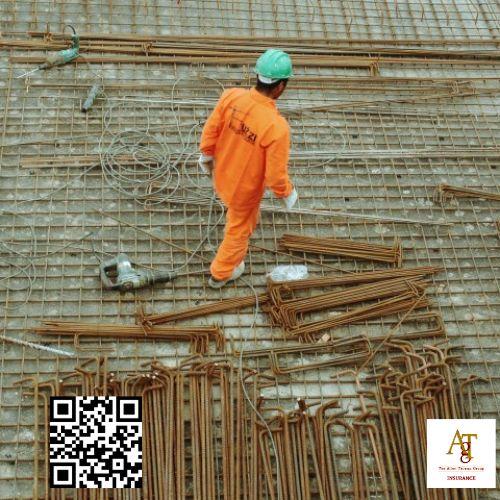

Liability Insurance For Construction Contractors

Underwriter

It offers contractors peace of mind by extending their liability coverage and ensuring they are adequately protected in case of large claims or lawsuits. This ensures that they have adequate coverage in the event of a claim, as exceeding the policy limits could leave them personally liable for any additional costs. This is covered by general liability insurance, an essential part of a contractors insurance policy. Call (440) 826-3676 for a free contractor insurance quote today. From custom policies designed specifically to fit individual responsibilities and exposures to policies tailored for public or non-profit institutions and financial institutions.

This major expense comes on top of work delays, decreased productivity and legal fees. The Allen Thomas Group Contractor Insurance . Learn six ways contractors can effectively manage their cost of risk to help improve their bottom line, their reputation and worker safety. Independent contractors typically have obligations under their work contracts regarding insurance requirements that must be fulfilled, which often state whether the company needs to be added as additional insured. Don't let this happen to you.

The Allen Thomas Group offers products and insights to help our customers stay ahead of risk by preparing for it and ultimately helping to reduce loss costs and keep projects running smoothly.

Liability Insurance For Construction Contractors - Business owners policy

- Equipment insurance

- Contractual liability

- Exclusion

- Marine insurance

- Commercial auto insurance

- Risk

As a contractor, you want an insurance resource who becomes an invaluable, long-term business partner. It combines both coverages under one policy, and usually has lower insurance premiums than buying each policy separately from the insurance company. One of the key components affecting contractors insurance costs is your specific trade's nature of work. Common trades that need contractors insurance include:It’s always good to have insurance in case of mishaps, even if you don’t contractually need coverage.

Liability Insurance For Construction Contractors - Underwriter

- Product liability

- Certificate of insurance

- Commercial umbrella insurance

- Small business insurance

- Equipment insurance

- Contractual liability

Liability Insurance For Construction Contractors - Certificate of insurance

- Risk

- Aggregate limit

- Property insurance

- Professional liability insurance